How an 80-Year-Old Couple Quadrupled Their Rental Income in 4 Years — A Real Case Study

Managing a property can become increasingly overwhelming for long-time owners—especially for those in their 70s and 80s.

What once felt manageable slowly turns into a daily responsibility: tenant communication, repairs, rent collection, compliance, and aging building systems that need attention.

This was the situation an 80-year-old owner couple faced before they partnered with American Vision Group in 2018.

Their goal was simple:

protect their retirement income without the burden of self-management.

What followed became one of the strongest value-creation results in our portfolio.

The Challenge: A Property With Potential, but Years of Deferred Needs

When the couple came to AVG, the property showed signs of long-term self-management:

- Outdated interiors and exterior

- Old windows causing energy inefficiency

- Deferred maintenance

- Below-market rent

- Good tenants mixed with problematic ones

- No long-term financial plan

- NOI stuck at $31,000

The owners were tired, overwhelmed, and unsure where to begin — but they still relied heavily on the rental income.

The Strategy: Stabilize Operations, Then Improve the Asset

Our approach focused on two phases:

1. Operational Stabilization

We immediately took over day-to-day management so the owners could step back. This included:

- Managing all tenant communication

- Reviewing rent collection and compliance

- Retaining long-term good tenants

- Addressing problem tenants

- Conducting a full operational + financial analysis

Once the property was stable, we moved to phase two.

2. Strategic Capital Improvements

To unlock income potential and strengthen the asset long-term, our team recommended targeted upgrades:

- Brand-new windows (efficiency + curb appeal)

- Fresh exterior paint (modernization)

- Interior updates (attract higher-quality tenants + support market rent)

These improvements weren’t cosmetic—they were high-ROI renovations designed to increase income, reduce future maintenance, and improve tenant quality.

The owners agreed with every recommendation and were fully engaged in the process — a major factor behind the results.

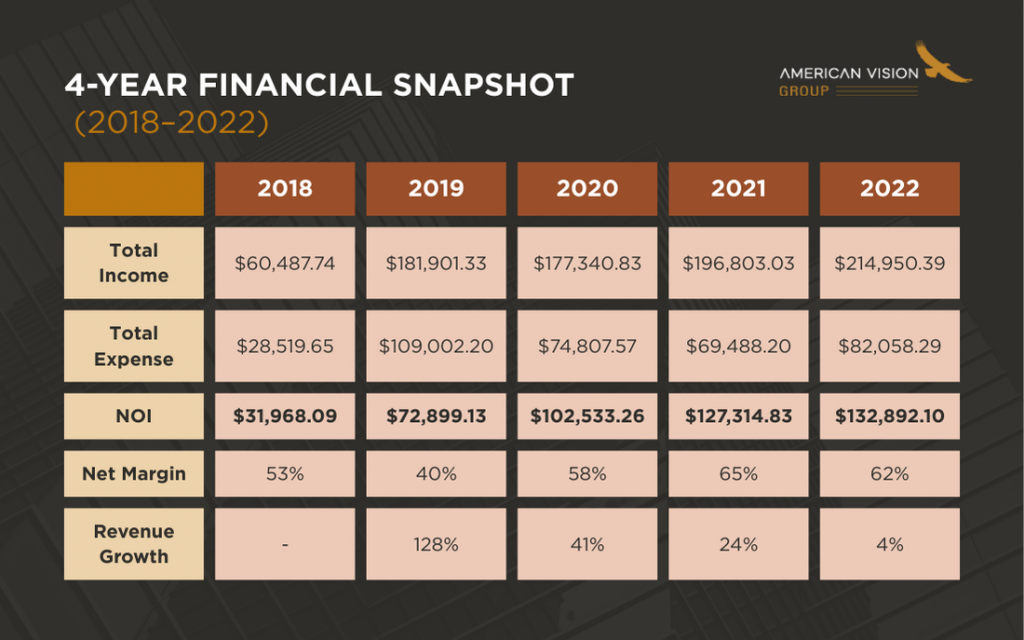

The Results: NOI Growth From $31K → $132K

With stabilization, responsible rent optimization (within city rent guidelines), and targeted improvements, the property experienced significant year-over-year growth.

In four years:

- NOI increased 4.16×

- Income more than tripled

- Expenses remained controlled

- Net margins remained healthy throughout the growth phase

- Revenue growth remained consistent

- The owners gained a more valuable, higher-performing asset

This directly strengthened their retirement income and long-term financial security.

🟠 2018 — Initial consultation with American Vision Group

This was the baseline year. The property was underperforming, NOI was low, and operations needed stabilization.

🟠 2018 → 2019 — Improvements and repositioning

After partnering with AVG, the owners approved key renovations and tenant adjustments.

Expenses increased during this period due to upgrades, but the property still maintained a 40% net margin, laying the groundwork for growth.

🟠 2020 — Expense control + targeted optimization

With major improvements complete, we reduced unnecessary costs and fine-tuned rent strategy.

Net margin increased to 58%, and revenue grew another 41%, showing strong operational efficiency.

🟠 2021 — Stabilization and maturity

Most value-add work was complete, and the property entered a stable performance phase.

Net margin strengthened to 65%, with 24% revenue growth driven by consistent operations and tenant quality.

🟠 2022 — Healthy, predictable long-term performance

The property continued to grow steadily, with a 4% revenue increase and a stable 62% net margin — meaning the owners kept 62 cents of every rental dollar after all expenses were paid.

This is what long-term, strategic property management is designed to achieve:

higher income, lower stress, and a property that performs consistently over time.

Why This Outcome Was Exceptional

While strong management and planning are critical, this result became exceptional for one key reason: The owners were fully invested in the process.

They:

- Trusted our strategic recommendations

- Approved the right upgrades at the right time

- Understood the long-term return on targeted reinvestments

- Allowed a full operational reset

- Supported responsible rent adjustments

- Collaborated closely with our asset management team

When owners and asset managers move in alignment, results compound.

That alignment made this case a standout success.

Key Insight for Property Owners

Many long-time owners underestimate how much value is locked inside their property simply because they’re too tired, too busy, or too overwhelmed to manage it strategically.

This case shows what becomes possible when a property is:

- Professionally managed

- Strategically renovated

- Financially optimized

- Supported by data-driven decision-making

The right property + the right strategy + the right management partner can reshape long-term income — at any age.

Curious What This Could Mean for Your Property?

Every property is unique. Every owner has different goals.

But the right management and improvement strategy can reveal value most owners don’t realize is possible.

If you’d like to explore what a transformation might look like for your own asset, our team is here to help you evaluate the next steps with clarity and confidence.