How to Grow Your Money Without Babysitting It

You’ve worked hard to build something — a business, a career, a life with purpose. But when it comes to growing your money, the landscape can be difficult to navigate.

There’s too much information, competing advice, and unfamiliar terms. One day the market is up. The next, it’s not. And unless you’re tracking financial trends closely, it’s hard to tell which opportunities are real and which are just distractions.

What if there were a way to grow your wealth — without constantly managing it?

In this article, we’ll explore a more stable, low-maintenance investment approach to building long-term value through real, grounded opportunities.

Why “Set-It-and-Forget-It” Feels Impossible These Days

The idea of passive investing sounds appealing — until you try to make it work.

Search for ways to grow your money, and you’re flooded with platforms, advice, and strategies. Some promise fast returns. Others require constant tracking and quick decisions.

For someone running a business or managing a busy life, this can feel more like a second job than a smart investment plan.

It’s not about avoiding responsibility — it’s about finding an approach that doesn’t demand daily attention or reacting to every market shift.

That’s why more people are asking a better question:

“Can I grow my wealth without constantly babysitting it?”

What Are Real Assets — and How Can They Work for You?

If you’re used to stocks or mutual funds, the idea of real assets might feel unfamiliar. But these investments have long been one of the most reliable ways to build wealth — especially for those who want to be hands-off.

Real assets are physical investments like land, housing, and infrastructure. Unlike paper assets, they’re tied to everyday use and long-term demand. People live in homes. Seniors need care. Land is developed for growing communities.

That makes real assets more than just income-producing — they’re purposeful, grounded, and historically stable.

“Ninety percent of all millionaires become so through owning real estate.” — Andrew Carnegie

Take senior housing, for example. With over 54 million Americans aged 65 and older — and that number expected to double — demand is accelerating. Yet many markets still face an undersupply. (Source)

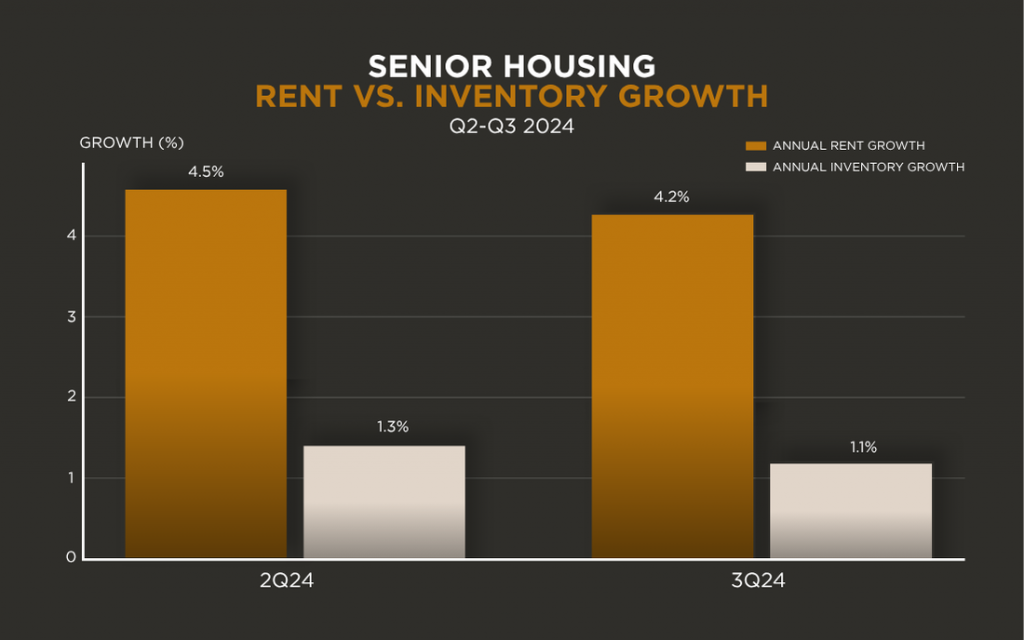

In fact, according to NIC, occupancy rose from 85.8% to 86.5% in Q3 2024 — while new inventory grew just 1.1%. Construction activity is also at its lowest level since 2009. That’s a clear signal: demand is rising, but new supply isn’t keeping pace.

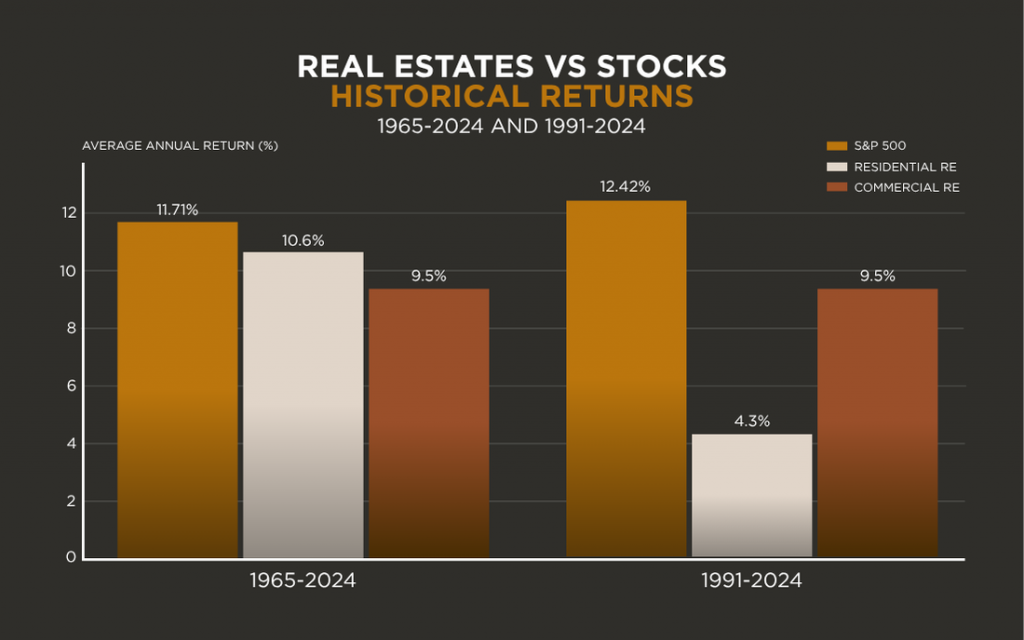

At the same time, real estate has delivered competitive returns with less volatility than stocks over the long term. (Source)

“Older adults are moving into senior housing at a rapid pace… We don’t foresee any meaningful movement [in supply] here in 2025 given current market conditions.”

— Lisa McCracken, head of NIC research, highlighting current supply constraints

Passive Doesn’t Mean Passive Returns

It’s a common assumption: if something’s easy to manage, it probably won’t grow much.

But when it comes to investing, that’s not always true.

Some of the most consistent income-generating opportunities don’t require constant attention — especially when they’re tied to long-term demand.

Senior housing, for example, isn’t just a trend. It’s responding to a real need that’s only growing.

“Passive investing is only passive in effort — not in outcome.”

— Inspired by the philosophy of John Bogle and Burton Malkiel

You don’t have to micromanage your money to make it work. With the right setup, it can grow quietly — and meaningfully — in the background.

How American Vision Group Makes This Work

At some point, most investors start asking a different kind of question — not just “Will this grow?”, but “What exactly am I growing?”

With real asset investing, the answer is often simple: something useful.

Housing. Senior care. Communities in development. These aren’t abstract plays — they’re connected to real demand, real people, and long-term investment trends that aren’t going away.

You’re not just investing in a number or a chart. You’re helping meet needs that already exist — and positioning yourself to benefit from that demand.

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

— Peter Lynch

For many of our clients, that’s the appeal: knowing their investment fits the bigger picture — without needing to manage every moving part.

It’s not about making a statement. It’s about making a smart, long-term investment that holds up over time.

Grow Wealth and Meaning

Your investments don’t have to live on a screen. They can live in the real world — in places that matter.

Like communities for aging parents. Or housing in underserved cities.

According to J.P. Morgan, there’s growing interest in values-aligned, purpose-driven investing — especially among those looking for clarity and long-term outcomes. (Source)

This isn’t charity. It’s smart, stable, meaningful wealth-building.

Let Your Money Work — Without Working You

If you’re looking for a way to grow your wealth passively — without tracking markets, reacting to headlines, or managing every moving part — real asset investing may be worth exploring.

At American Vision Group, we help professionals grow their wealth through real assets backed by long-term demand.

Our approach is:

✅ Tangible – focused on senior housing, land, and housing developments

✅ Proven – over $200M in assets under management, built through real-world projects, not speculation

✅ Low-maintenance – structured to generate income without constant oversight

✅ Guided – grounded in over 10 years of experience helping investors navigate alternatives with clarity

✅ Personalized – designed for those who want performance without pressure

What would it look like if your money grew — without demanding more of your time?

If that’s the kind of shift you’re looking for, we’d love to hear from you.

Reach out to American Vision Group directly at:

Email: invest@americanvisioncap.com

Phone: +1 (626) 765-4999 ext. 0

No pressure. Just clarity.