What Are Real Assets? Why Smart Investors Are Doubling Down Now

If watching the market gives you a headache, you’re not alone.

Between the ups, the downs, and the endless expert opinions, it’s easy to feel stuck. You’re working hard to build something real — your business, your family’s future — but where does your money actually grow safely?

Lately, more investors are turning to real assets.

Not trends. Not hype. Just tangible, income-producing investments with long-term value.

From swirling rumors about Fed Chair Powell’s job security to fresh tariff threats shaking global trade relations, today’s headlines are giving investors plenty of reasons to rethink their next move. In the face of all this noise, it’s no surprise that many are turning to simpler, more grounded strategies.

Here’s what that really means and why it might be the smartest move in 2025.

What Are Real Assets, Really?

When most people think of investing, they think of stocks, bonds, or mutual funds — things you can’t see or touch. These are called financial assets, and while they’ve been the default for decades, they come with one big drawback: they’re tied to the moods of the market.

Real assets, on the other hand, are tangible.

They include real estate, land, infrastructure, or even farmland — things you can walk on, rent out, or physically own. They don’t just sit on a balance sheet. They generate income and tend to hold their value, especially when the markets get rocky.

Here’s a quick breakdown:

For investors looking to step outside the daily rollercoaster of the stock market, real assets offer something different, something real.

“Current market uncertainties can create unrest and anxiety that force folks to stay on the sideline. Don’t let it stop you from invest in long term.”

— Stephanie Lin, CEO, American Vision Group

Why Smart Investors Are Doubling Down Now

Real Assets Are Holding Their Own — Even in a Noisy Market

For many investors, the traditional formula — stocks, bonds, repeat — is starting to feel shaky. Volatility is high, inflation eats into returns, and the future feels uncertain.

That’s why more people are shifting their attention to real assets.

Commercial and residential real estate, in particular, have shown long-term strength.

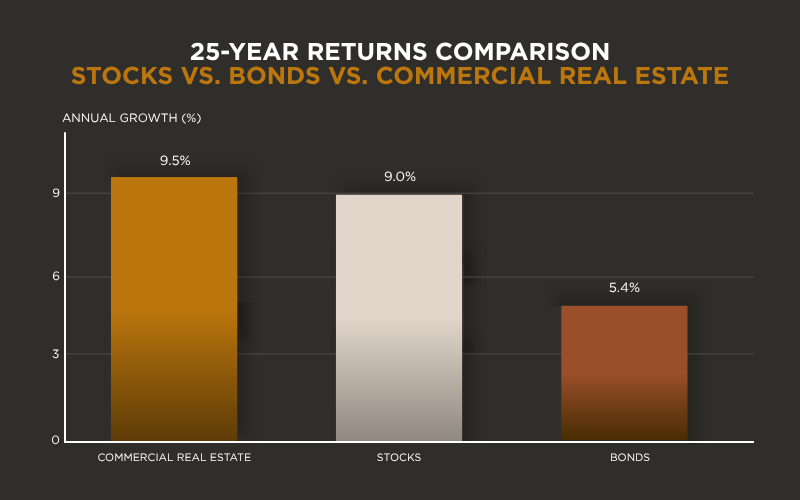

In fact, one recent analysis showed that commercial real estate consistently outperformed stocks over 25-year periods, with lower overall volatility (Source).

And it’s not just about performance — it’s about reliability.

When markets swing wildly, real assets offer something grounded. They don’t disappear with headlines. They continue to generate income, retain value, and align with long-term goals.

Over the past 25 years, commercial real estate has delivered higher average annual returns (9.5%) than both stocks (9.0%) and bonds (5.4%). For long-term investors seeking strong, consistent performance outside the public markets, this asset class continues to stand out.

Among real assets, one of the clearest and most timely examples is senior housing. Why? Because it checks all the boxes: it’s a physical, income-generating property that’s less prone to market mood swings and it meets a growing, needs-based demand that won’t slow down with economic cycles.

In fact, senior housing doesn’t just represent a real asset — it showcases why real assets matter now more than ever.

Demand Is Accelerating, Especially in Sectors Like Senior Housing

Real assets aren’t static, they grow as the world changes.

One of the most talked-about trends is the “Silver Tsunami.” The surge of aging Americans driving demand for senior housing.

- Over 54 million Americans are 65 or older today.

- That number is expected to double in the coming decades.

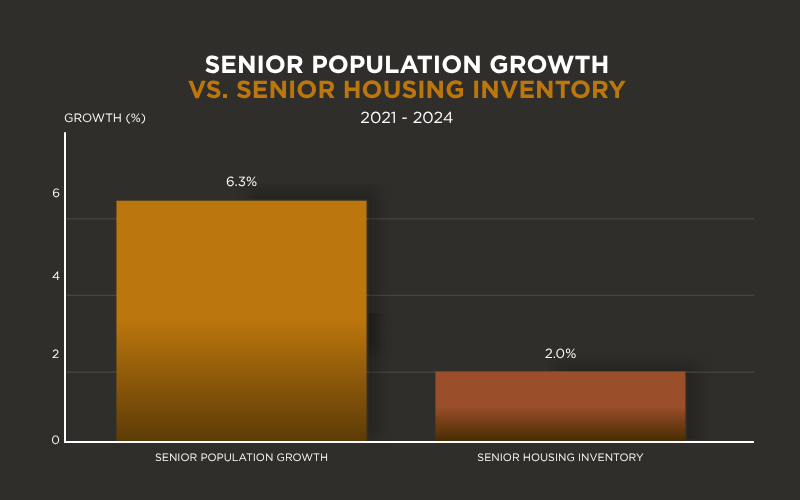

- Yet the supply of senior living facilities hasn’t kept up.

This imbalance is already being felt.

A June 2025 Forbes article called senior housing one of the most promising sectors for real estate investors today (Source).

As the 75+ population grew by 6.3% between 2021 and 2024, senior housing inventory expanded just 2.0%.

This growing gap signals a strong demand-driven opportunity — one that positions senior housing as a high-need, real-world investment.

Why Real Assets Are Backed by More Than Just Hype

Today’s markets are noisy but real assets offer something solid.

These are investments tied to tangible things: housing, infrastructure, farmland. Not just lines on a screen — but properties and services people rely on, with value that holds.

Why they’re gaining traction:

✅ Steady income from rent or leases

✅ Less volatility than public markets

✅ Hard value, not just paper gains

✅ Real-world impact — like housing for aging communities

And the best part? You don’t have to manage them yourself. With experienced operators at the helm, real assets let you stay hands-off while your money works.

That’s the approach we take at American Vision Group — offering access to income-generating real estate and senior housing opportunities built for long-term value.

Ready to See How It Could Work for You?

You don’t need to master the markets.

You just need the right foundation and the right partners.